capital gains tax rate canada

If you earned a capital gain of 10000 on an investment 5000 of that is taxable. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets.

Reporting Capital Gains Dividend Income Is Complex Morningstar

The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year.

. Under Canadas tax system you have the right and responsibility to determine your income tax status and make sure you pay your required amount of tax each year according to the law. The capital gains inclusion rate is 50 in Canada which means that you have to include 50 of your capital gains as income on your tax return. Only 50 of the capital gains of stocks are taxable at the individuals.

You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and. 10 hours agoHunt is also looking at increasing the headline rate of capital gains tax CGT The Telegraph reported later on Thursday. The Capital Gains Exemption CGE remains one of the most beneficial components of the Canadian tax system.

As of 2022 it stands at 50. The inclusion rate has varied over time see graph below. So if you make 1000 in capital gains on an investment you will pay capital gains tax on.

Following the remaining 100000 earnings of business profit from Company X will be subjected to a tax rate of 265. Again in Canada capital gains get a better tax treatment and are taxed at a lower rate than both dividends and interest. Rewarding resident Canadian business owners for.

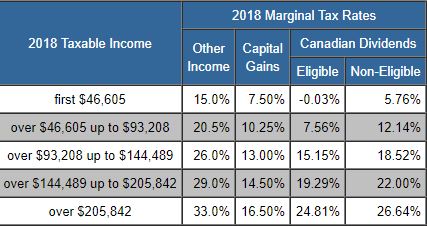

For a Canadian who falls in a 33 marginal. In Canada capital gains are taxed at 50 of your marginal rate. Capital Gains Corporate Tax Rate Canada.

Lets say you sold BMO which I would never do its one of my favourite Canadian dividend stocks for a profit of. A capital gain refers to any profit made by selling capital or passive assets including businesses stocks shares goodwill and land. This results in a total tax liability on the business income of.

On a capital gain of 50000 for instance only half of that amount 25000 is taxable. The sale price minus your ACB is the capital gain that youll need to pay tax. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs.

Your sale price 3950- your ACB 13002650. In Canada capital gains are taxed at a rate of 50 of the gain if the asset is sold within one year of it being bought and at a rate of 2667 if the asset is held for longer than. The inclusion rate has varied over time see graph below.

The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. The finance minister is reviewing changes to the. Without the deferral election the appreciation of 250000 from Year 1 to Year 5 is taxable in Year 5 even though you didnt truly.

And the tax rate depends on your income. A Canada Capital Gains Tax Calculator formula that will allow you to manually crunch numbers and get your rate. So for example if you buy a stock at 100 and it earns 50 in value when you sell it the total capital.

Deferral election is not taken but can claim CCA. The capital gains tax is the same for everyone in Canada currently 50. The inclusion rate for personal.

As of 2022 it stands at 50. In Canada 50 of the value of any capital gains is taxable. Since its more than your ACB you have a capital gain.

The inclusion rate is the percentage of your gains that are subject to tax.

Canada Capital Gains Tax Calculator 2022

Entrepreneurship Growth And Capital Gains Taxation

Demographics And Entrepreneurship Blog Series Spurring Entrepreneurship Through Capital Gains Tax Reform Fraser Institute

Taxtips Ca Canada Federal 2017 2018 Income Tax Rates

Understanding Taxes And Your Investments

It S Time To Increase Taxes On Capital Gains Finances Of The Nation

New Tax Rules For Canadian Controlled Private Corporations Madan Ca

Historical Capital Gains Rates Wolters Kluwer

Canada Crypto Tax The Ultimate 2022 Guide Koinly

The Capital Gains Tax It Should Be Reduced Not Increased Iedm Mei

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

The Capital Gains Tax And Inflation How To Favour Investment And Prosperity Iedm Mei

Biden Capital Gains Tax Rate Would Be Highest For Many In A Century

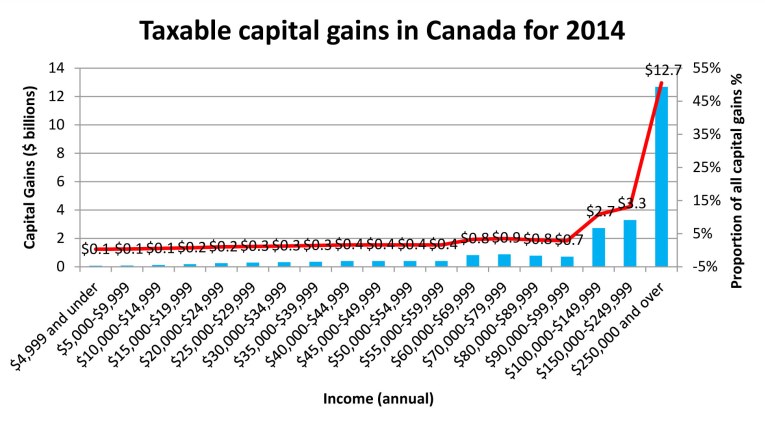

Too Many Analyses Misrepresent Capital Gains Income And Taxes Fraser Institute

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

How Are Capital Gains Taxed Tax Policy Center

Good Tax Policy Helped Canada Become Home To The World S Most Affluent Middle Class Tax Foundation

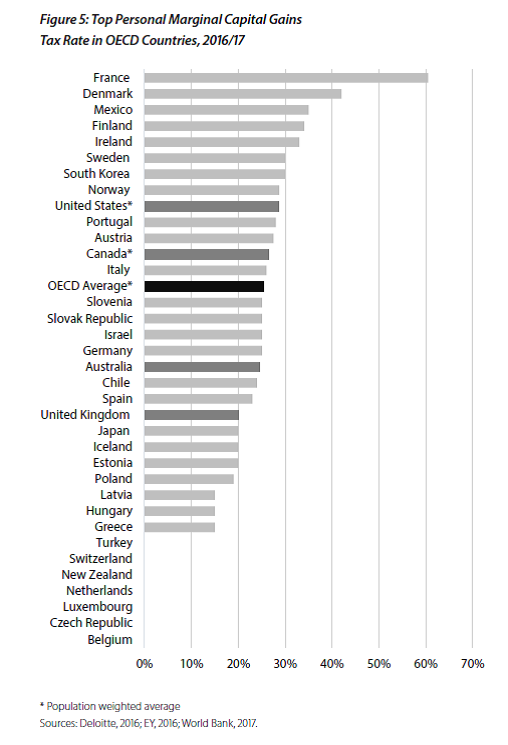

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Capital Gains Tax Canada Makes This The Cheapest Tax You Ll Ever Pay